Conventional Loan Dti Limits 2024

Conventional Loan Dti Limits 2024. By neighbors bank team october 27, 2023. Conventional loan limits are the maximum amount a person can get when applying for.

Confirmation of conventional loan limit values for 2023;. By neighbors bank team october 27, 2023.

In 2024 The Conventional Loan Limit Is $766,550, Which Is A Sizable Bump From 2023.

Conventional loan limits are the maximum amount a person can get when applying for.

Portfolio Loans May Have More Lenient Standards For.

Generally speaking, for conventional loans your dti ratio can be up to 50%, cohen said.

For 2024, The Conventional Loan Limit Is $766,550.

Images References :

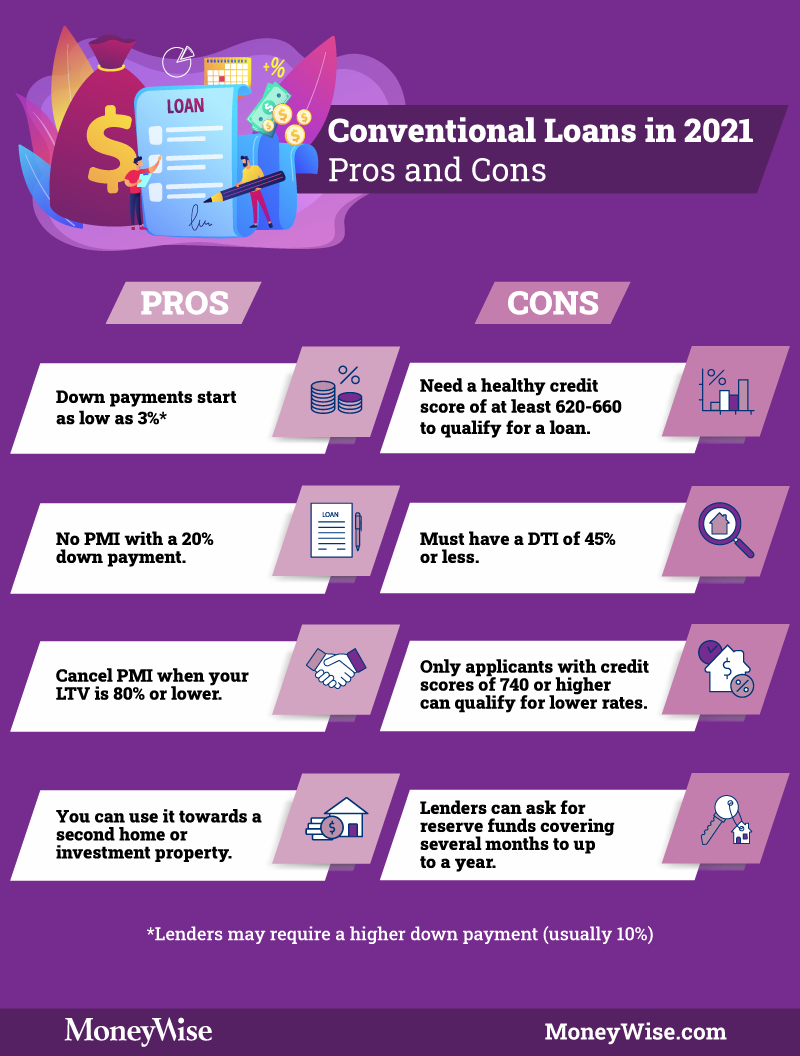

Conventional Loan Requirements for 2024, In 2024 the conventional loan limit is $766,550, which is a sizable bump from 2023. In 2024, a buyer needs a credit score of 620 or higher for a conventional mortgage loan.

Source: www.moneygeek.com

Source: www.moneygeek.com

2023 Conventional Loan Requirements, What is a conventional loan? This means that you can borrow up to $766,550 in most areas.

Source: www.youtube.com

Source: www.youtube.com

Conventional Loans (DTI) Ratio YouTube, What is the dti limit for usda loans? For a conventional loan, lenders prefer a dti ratio under 36 percent.

Source: themortgagereports.com

Source: themortgagereports.com

Conventional Loan vs FHA Loan 2024 Rates and Guidelines, Conforming loans adhere to the maximum loan limits set by the federal housing finance agency (fhfa) and meet the funding criteria of fannie mae and. However, dtis up to 43% are commonly allowed.

Source: www.pinterest.com

Source: www.pinterest.com

How To Calculate DTI in North Carolina in 2022 Fha loans, Debt to, This is a comparatively low rate, squarely in the middle of the “fair” score range. Loan size for a conforming.

Source: fhajournal.com

Source: fhajournal.com

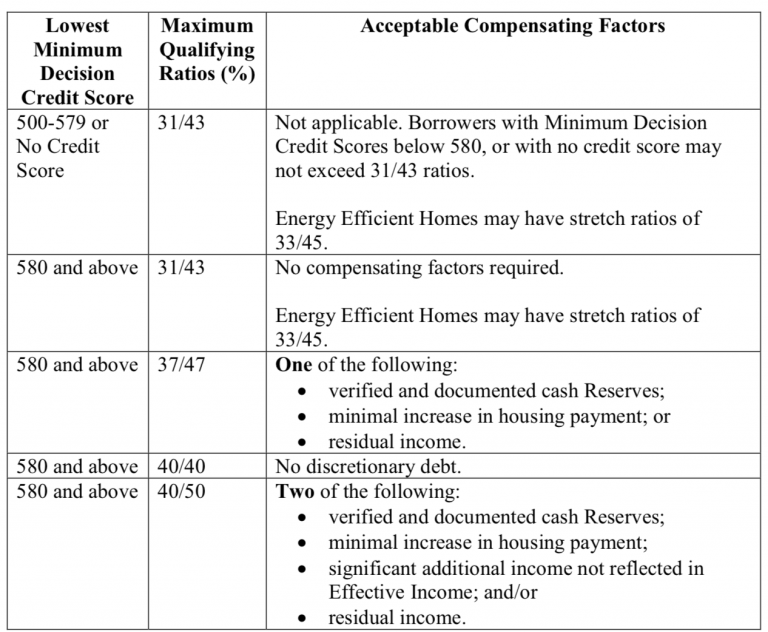

FHA Ratio, Calculator, Requirements for FHA DTI Loan, In certain cases, you may even qualify. Required until you reach 20% equity in your home.

Source: gustancho.com

Source: gustancho.com

Credit And DTI Guidelines On Conventional Loans Versus FHA Loans, For 2024, the conventional loan limit is $766,550. Conforming loans adhere to the maximum loan limits set by the federal housing finance agency (fhfa) and meet the funding criteria of fannie mae and.

Source: gustancho.com

Source: gustancho.com

Ratio For Conventional Loan Guidelines, What is a conventional loan? Usda dti limits and requirements 2024.

Source: imanotalone.blogspot.com

Source: imanotalone.blogspot.com

How To Apply Dti Loan Program Covid Ethel Hernandez's Templates, For a conventional loan, lenders prefer a dti ratio under 36 percent. Conforming loans adhere to the maximum loan limits set by the federal housing finance agency (fhfa) and meet the funding criteria of fannie mae and.

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png) Source: medogi.com

Source: medogi.com

FHA Loans vs. Conventional What’s the Difference? (2023), So if you earn $10,000 per month and want to get a mortgage for a home with monthly housing expenses of $3,500 per month, yet you have a $500 per month car. For a conventional loan, lenders prefer a dti ratio under 36 percent.

How Do You Qualify For A Conventional Home Loan?

The limit is higher in alaska and hawaii, where the number is.

This Means That You Can Borrow Up To $766,550 In Most Areas.

Conforming loans adhere to the maximum loan limits set by the federal housing finance agency (fhfa) and meet the funding criteria of fannie mae and.